| juliajubilada = julia retired |

|

Notes on the 2nd edition, 2017The club of Rome’s ‘Limits to growth’ (1972) predicted running out of oil etc but it’s all happening faster than they predicted.

Cites Graeber re. debt preceding money creation and Lakoff re household debt as a metaphor for govt debt. Cites Picketty re. richest 1% getting richer when credit is cheap. Cites Minsky’s 3 stage borrowers: 1) borrow & repay 2) borrow more to repay principal 3) borrow more to pay interest – defaults create instability so regulation is needed. The easy credit & deregulation leading up to 2008 crisis all originate in allegiance to growth. Stucker & Basu (2014) chart impact of austerity in Greece and other post-crash ‘experiments’ (eg Iceland). Now growth is slowing down everywhere economists are beginning to question growth as a basis for stability. |

|

Notes and diagrams to download are clearer to read than here but the pdf notes don't include links & references

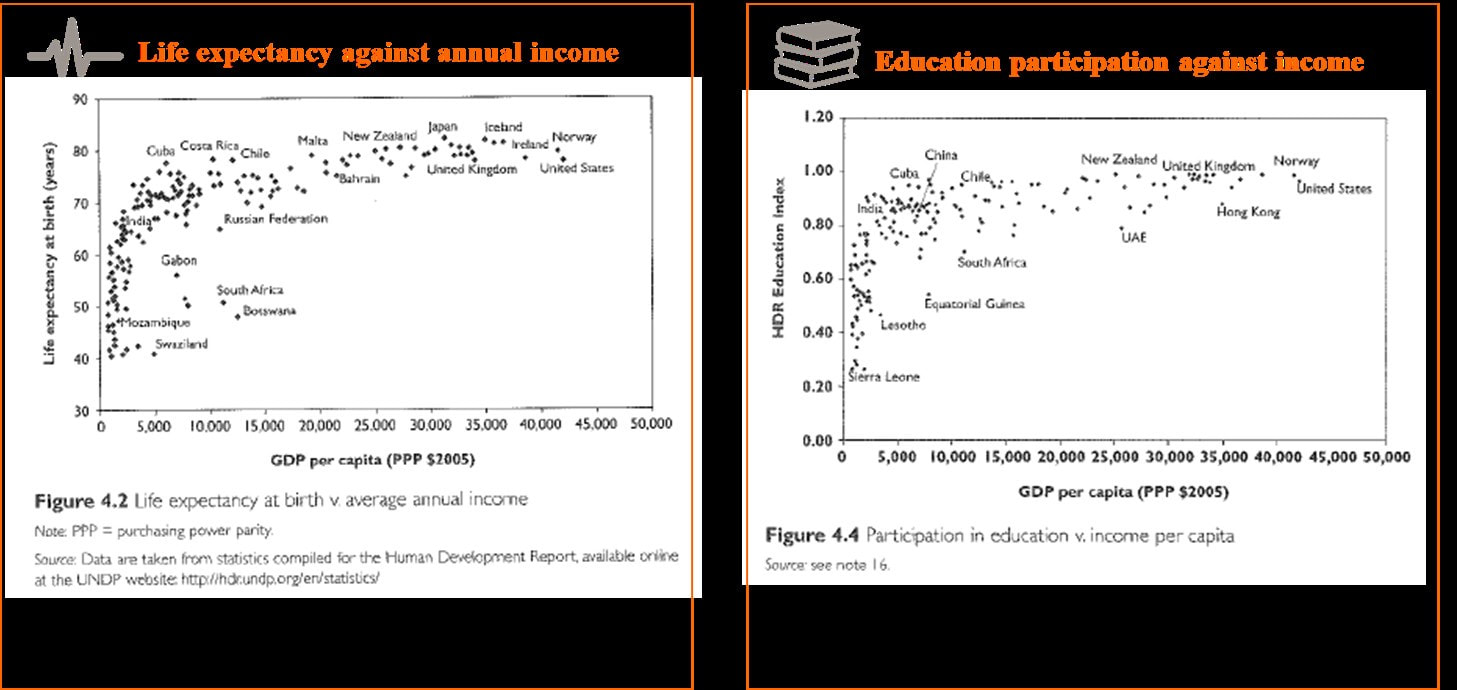

Relation between material wealth and happiness (also health, education, participation etc) is closer for poorer people but once you get to the “sweet spot” (see examples below )it doesn’t make much difference. |

Prosperity can be re-defined as:

· capabilities to flourish - get food, shelter, self-esteem, participation in society (Amartya Sen) · Central human capabilities—life, health, education (‘practical reason’), physical safety, affiliation (Martha Nussbaum) Also ‘ecological resiliance’ Steepest correlation of life expectancy/ infant mortality with GDP is in poorest countries but stark anomalies in eg Cuba, Costa Rica, Chile where they’re much poorer but live longer lives than in USA. Infant mortality in Armenia lower than in US despite earnings being 5% of what they earn in the US. And education (years of schooling) puts Estonia above Japan, Ireland and Norway. So the lessons from this:

|

The dilemma of growth

We need food and shelter but don’t need much more than that to flourish so why do we over-consume?

- addictive aspects of consumption (the more we get the more we want)

- cultural significance of stuff (peer pressure to conform, identity, feelings expressed through gift exchange

The myth of decoupling

Ie sustainable growth, green growth or growth without destruction

Relative decoupling = doing more with less. Much of the energy/CO2 emissions recorded in poor countries is used in producing stuff for rich countries. So while some countries look like they’re on track, it’s at the expense of others. Lots of sums show that we can’t let poor countries ‘catch up’ with rich without environmental catastrophe. And we can’t save the planet without ‘confronting the structure of market economics’

The Iron Cage of Consumerism

Profit motive leads drive for new, cheaper, more and wider markets driving more consumption. Energy efficiency lowers costs so more is produced AND people can spend the cash saved on even more stuff (so more energy used).

Flourishing within limits

At times of crisis and recession people stop shopping and star saving. Enhanced mobility results in loneliness, social isolation

Foundations for an economy of tomorrow

Enterprise as service (ie as a form of social organisation)

Focus on service = provision of goods in ways that provide prosperity defined as food, shelter, energy, transport, health, identity, affiliation, participation, creativity

Goal of enterprise:

- capabilities for people to flourish

- tread lightly on the earth

- work as both livelihood and as social participation – cut working hours & do more care, craft and creativity

- investment as commitment to the infrastructure of civic life, renewable energy (invest to divest

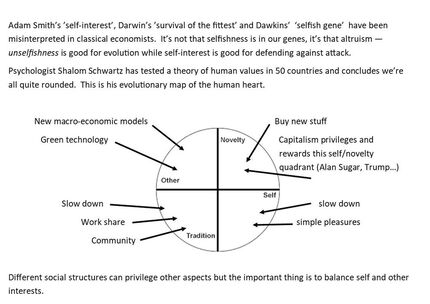

Evolutionary map of the human heart (Self/Other Novelty/Tradition)

Money as Social Good

Community banking eg SPEAR (France), Unified Field Corporation (US) credit unions, Triodos (only lends its own deposits and sovereign money proposals in Iceland and Switzerland. Jackson says, “Handing the power of money creation over to commercial interests is a recipe for financial instability, social inequality and political impotence” (157)

Does credit create a growth imperative?

You can’t stop growth without dismantling capitalism but Wynne Godley developed Stock Flow Consistent (SFC) economic models based on 3 axioms:

- each expenditure for A = income for B

- A’s financial assets = B’s liabilities Total = 0

- Changes in stocks of financial assets = flows within and between economic sectors.

Towards a post-growth macroeconomics

Baumol “The cost disease” says the ‘stagnant sector’ (eg repair services when it’s cheaper to buy new, local theatres – people won’t pay enough to cover actors’ wages) is in danger of disappearing. Health, education, ect are under constant pressure to make efficiency savings at the expense of ecology (repairs, recycling) or health. So value of ‘output’ per hours worked declines with rise in services. (See Victor & Jackson Zero Growth economics). Jackson challenges Picketty’s algebra in his argument that links growth of inequality to declining growth rates so advocates growth + tax on profits to redress inequality.

The stabilising role of government

Govt spending can stabilise economy and Victor and Jackson’s models (see prosperitas.org.uk) show how damaging austerity is. Post-growth macroeconomics provides an integrated framework for high levels of employment, social investment, more equality and financial stability. It’s work in progress but all possible!

The progressive State

Even Adam Smith argued for govt regulation to protect people from corporate greed. But post 2008 has shown how govt is in the pay of the greedy corporations. Elinor Ostrom (1st woman to get nobel prize for economics) showed how when cows are grazing on common lands there’s over-grazing – nobody takes care of the land – and cows go hungry. Profit motive encourages people to care so private land makes fat cows. Osrom’s remedy is local government and, for oceans, climate and money systems you need higher levels of government.

Four policy themes for a post-growth society

- Establishing limits: get best possible scientific data and act early to meet climate targets

- Countering consumerism: curb advertising, establish commerce-free zones, trading standards for durability, invest in public amenities, strengthen communities

- Tackling inequality – arguments from Spirit Level – restructure wages & incomes, UBI (doesn’t mention tax)

- Fixing economics – reforming capital markets and laws against destabilising financial practices, social investment, protect and support ‘employment rich’ sectors, bring in sovereign money

Re-cap – we need to distinguish what matters from what glitters

Frugality – etymology = ‘being for the good fruit’ (ie honest, temperate, dedicated to long-term flourishing.

Prosperity = a condition that includes obligations and responsibilities to others. Not the end of capitalism but the end of casino capitalism, more public ownership an control of natural assets.